Social Impact Bonds: Innovating Cities Financing Social Programs

Richmond, Calif. joined Cities of Service in 2012 and is undertaking neighborhood revitalization using the Cities of Service Love Your Block blueprint.

“E

very dollar we spent (on disaster preparedness) saved five dollars in future losses.”[1] “Chicago’s preschool program generates $11 of economic benefits over a child’s lifetime for every dollar spent initially on the program,” according to one study. “$10 a person per year invested in prevention could save billions.”[2]

So, if we know that investing in disaster preparedness, early childhood education and preventive health save money, why don’t we do it? One reason is that we don’t have the money to invest. With governments struggling to maintain basic services while meeting their obligations to retirees, there isn’t enough money, even to make profitable investments. So, how are we to pay for social programs?

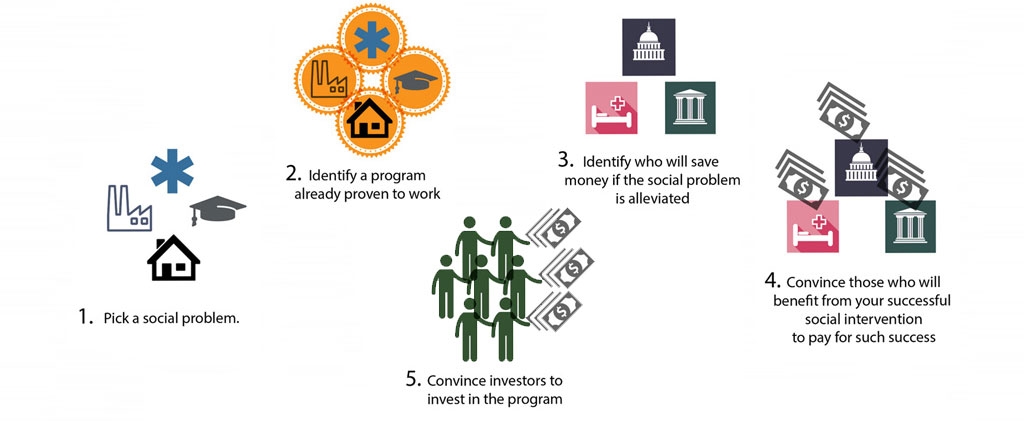

One answer is what are called “Social Impact Bonds”. The premise is that, if we can capture, or monetize, those savings, we can use some of those savings to repay investors. In other words, we can create privately financed social programs.

The Richmond (California) Community Foundation (“RCF”) is working on a Social Impact Bond targeting blighted housing. The City of Richmond has an oversupply of deteriorating houses. RCF is working with the City of Richmond, which will issue $3 million in bonds, then give the money to RCF, which will purchase boarded-up houses, rehabilitate them and sell them. The bondholders will be repaid from the proceeds of the sales of the houses.

The four primary challenges of establishing a Social Impact Bond are:

1. Finding proven programs. Many exist. Private foundations and governments have for decades been funding experiments and start-up programs to prove whether social interventions work; the difficulty has always been to finance the on-going program once the seed money has dried up. The benefits of cleaning up blighted neighborhoods have been demonstrated in cities around the country.

2. Producing a real return on investment. Not all interventions, no matter how beneficial, can result in an actual financial return, but there are enough that there is an attractive menu of possibilities. In Richmond, both the County and the City will realize real financial benefits from reduced code and law enforcement costs and increased property tax revenues.

3. Convincing those who benefit to share with the program. The source of the money to repay the bondholders is the financial benefit realized from the program, so those who realize that benefit must be convinced to give up some of that benefit. In Richmond, the City and the County are willing to share their code enforcement and law enforcement cost savings and property tax windfalls with RCF to help repay the bonds.

4. Attracting investors. The market for Social Impact Bonds is new, and the programs bear above-market risks.[3] There are, however, investors willing to invest, some out of philanthropic motives, others because they are incentivized to do so. The former include private and family foundations willing to make “Program-Related Investments” (PRI) and socially-responsible mutual funds. The latter include banks that need to meet their Community Reinvestment Act obligations. Right now, banks are eager to invest their CRA funds in Social Impact Bonds, and are content with modest returns. In the long run, however, the viability of Social Impact Bonds depends upon being able to deliver risk-adjusted market-rate returns.

Social Impact Bonds should be considered for financing a wide variety of social programs. They are especially well suited to public health programs and to programs that prevent adult and juvenile incarceration, because disease and injury treatment and incarceration are incredibly expensive, there are programs proven to prevent both, and it’s not difficult to identify those who will realize real financial savings. On the other hand, Social Impact Bonds are not always appropriate. For example, diabetes is one of our largest public health issues, but it may not be well-suited for a Social Impact Bond, because the amount of time between the prevention program and when the benefits are realized may be so long that the causation is attenuated and the actual financial benefits difficult to document.

Social Impact Bonds can be a viable strategy to address particular social needs in cities, but should be given careful consideration.

. . .

Joshua Genser is a consultant on Social Impact Bond and Pay-for-Success programs. Josh, along with the staff of the Richmond Community Foundation and the City of Richmond, is spearheading Richmond’s revolutionary Housing Blight Remediation Program funded with Social Impact Bonds. www.socialimpactbonds.us